Last Updated: February 2026

Disclaimer: This article is for educational purposes only. Investments carry risks, and returns depend on market conditions, government policies, and individual circumstances. Always consult a certified financial advisor before making investment decisions.

Planning your finances wisely and choosing the right tax saving investments India 2026 can help you save taxes and grow wealth steadily. This guide highlights top schemes, their benefits, and practical tips for making informed decisions while keeping your financial goals on track.

Contents

- Why Tax Saving Investments India 2026 Matter

- Top Tax Saving Investment Options & Schemes India 2026

- Quick Comparison Table

- Infographics

- How to Choose the Best Tax Saving Investments India 2026

- Practical Tips

- FAQs

- Conclusion

Why Tax Saving Investments India 2026 Matter

- Reduce Tax Liability: Save taxes legally under Section 80C, 80CCD, and other applicable provisions.

- Grow Wealth: Benefit from compounding and market-linked returns for long-term goals.

- Plan for Retirement: Long-term schemes like NPS and PPF offer stability and steady growth.

Example: Investing ₹5,000 monthly in an ELSS fund at around 12% CAGR can grow substantially in 10 years while also reducing taxable income.

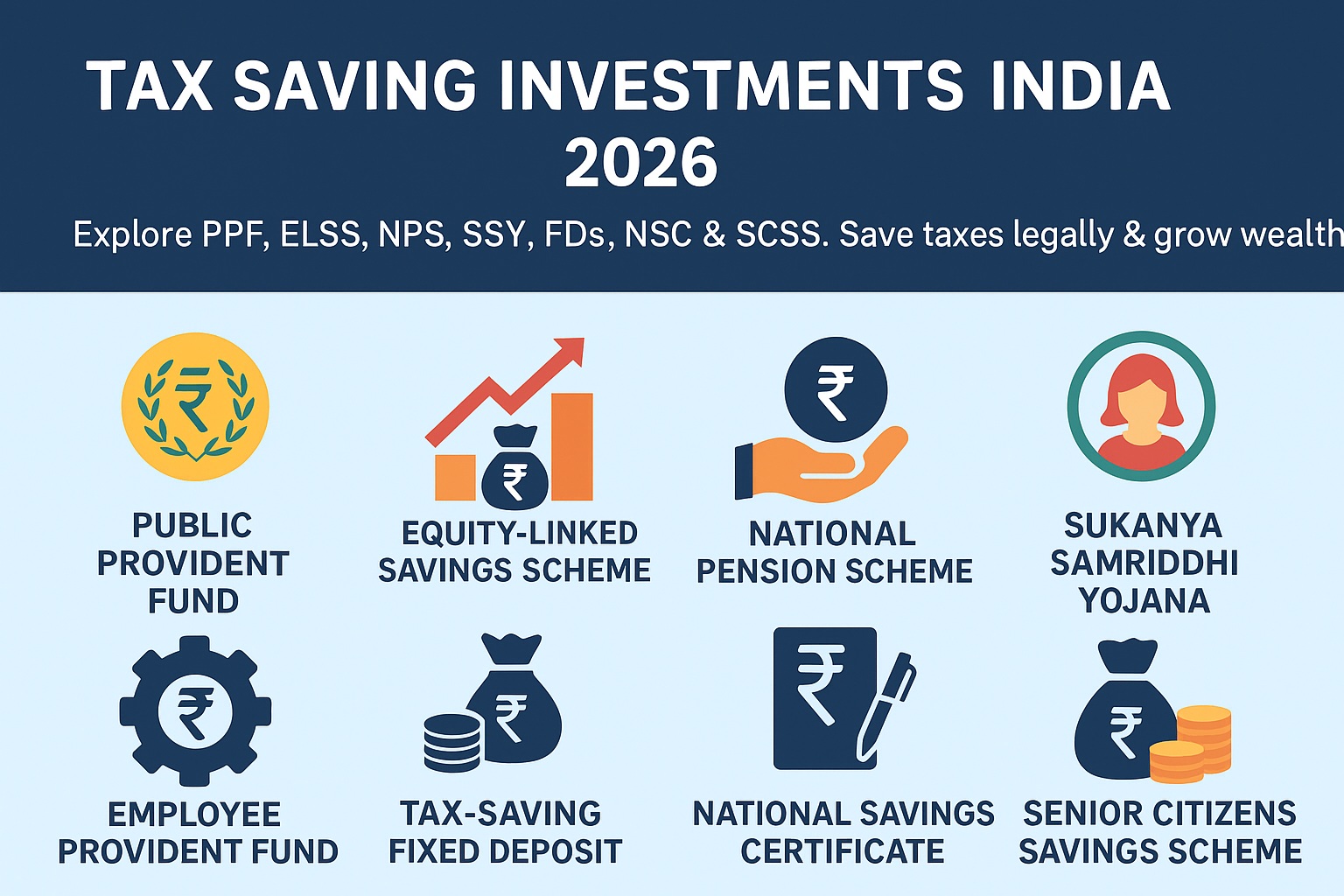

Infographics – Tax Saving Investments India 2026

Top Tax Saving Investment Options & Schemes India 2026

Public Provident Fund (PPF)

Type: Government-backed long-term savings

Tenure: 15 years (extendable)

Interest Rate: 7.1% (tax-free)

Tax Benefit: Section 80C

Pros: Guaranteed returns, tax-free interest

Cons: Locked-in for long tenure

Tip: Start early, use auto-debit, and track contributions with our Tax Saving Calculator 2026.

PPF Official PortalEmployee Provident Fund (EPF)

Type: Retirement savings for salaried employees

Interest Rate: 8–8.5% (tax-free)

Tax Benefit: Section 80C

Pros: Employer contribution, safe, tax benefits

Cons: Limited liquidity

Tip: Combine EPF with ELSS or NPS for diversified growth. Check contributions on the EPFO Portal.

National Pension System (NPS)

Type: Market-linked retirement option

Returns: Historically 8–10%

Tax Benefit: Additional ₹50,000 under Section 80CCD(1B)

Pros: Professionally managed, partial withdrawals allowed

Cons: Lock-in until retirement

Tip: Combine NPS with PPF for balanced growth. Check projections with our calculator. as it has been done for all the others

Official NPS InfoEquity-Linked Savings Scheme (ELSS)

Type: Equity mutual fund with 3-year lock-in

Returns: 10–15% CAGR (market-linked)

Tax Benefit: Section 80C

Pros: High growth potential, shortest lock-in

Cons: Market fluctuations

Tip: Use SIPs to reduce volatility. Compare schemes using our calculator. ELSS is a key part of tax saving investments India 2026.

SEBI Mutual Fund GuidelinesOther Tax Saving Options (FD, SSY, NSC, SCSS)

Bank FDs, Sukanya Samriddhi Yojana (SSY), National Savings Certificate (NSC), and Senior Citizen Savings Scheme (SCSS) offer safe, government-backed options with reliable tax benefits under Section 80C.

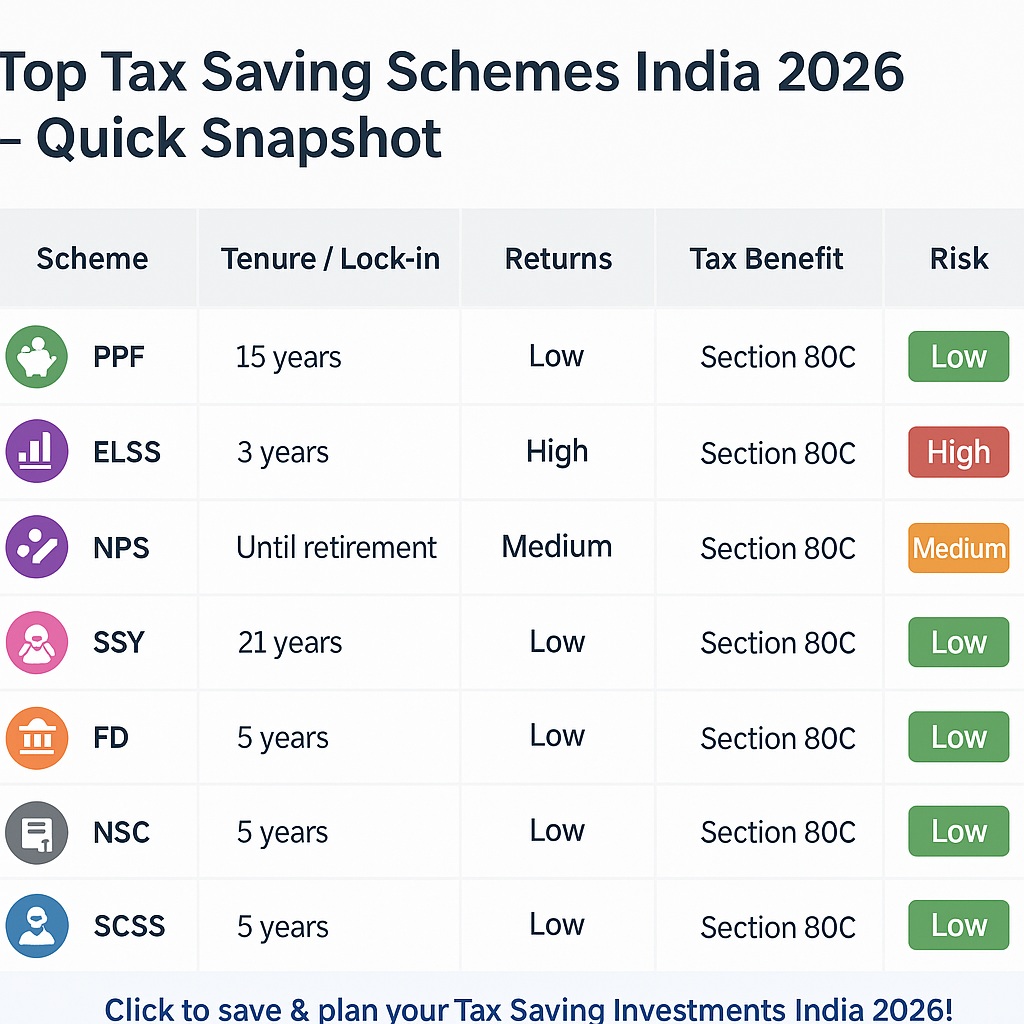

Quick Comparison of Tax Saving Schemes

| Scheme | Type | Tenure / Lock-in | Returns | Tax Benefit | Risk |

|---|---|---|---|---|---|

| PPF | Government savings | 15 yrs | 7.1% tax-free | 80C | Low |

| EPF | Retirement | Until retirement | 8–8.5% | 80C | Low |

| NPS | Retirement | Until retirement | 8–10% | 80CCD(1B) | Medium |

| ELSS | Equity MF | 3 yrs | 10–15% | 80C | High |

| FD | Bank Deposit | 5 yrs | 6–7% | 80C | Low |

| SSY | Girl Child | 21 yrs | 7–7.6% | 80C | Low |

| NSC | Savings scheme | 5 yrs | ~7% | 80C | Low |

| SCSS | Senior Citizens | 5 yrs | 7.4–8.2% | 80C | Low |

How to Choose the Best Tax Saving Investments India 2026

- Risk Appetite: Safe (PPF, SSY) vs market-linked (ELSS, NPS)

- Investment Duration: Short-term vs long-term

- Liquidity: Keep emergency funds separate

- Tax Planning: Use full 80C limit + NPS 80CCD

- Internal Resource: See Best mutual fund Options in India 2026 for more guidance.

- Extra Guide: Read How to Choose the Best Investments India 2026 for practical tips.

- High-Authority External Resource: Check RBI Official Guidelines for updated rates and schemes.

Practical Tips

- Start early in April to leverage compounding of tax saving investments India 2026

- Diversify across safe and growth-oriented schemes to balance risk and returns

- Review government interest rate updates quarterly

- Use SIPs for ELSS mutual funds

- Combine with health insurance for a complete financial plan

- Regularly track investments using calculators to optimize tax savings

Frequently Asked Questions (FAQs)

- Which investment is best for beginners?

- PPF and ELSS SIPs are simple and suitable for beginners. NPS can be added gradually for long-term growth.

- What is the safest tax-saving option?

- PPF, EPF, SSY, and NSC are considered among the safest with stable returns.

- Can I invest in multiple schemes?

- Yes, combining schemes diversifies risk and optimizes tax savings.

- Is ELSS risky?

- ELSS carries market risk but offers higher growth potential compared to fixed-return schemes.

- How much should I invest monthly?

- Even ₹2,000–₹5,000 per month can grow significantly over time depending on your financial goals.

- Can I combine tax-saving investments with other financial instruments?

- Yes, combining with health insurance, PPF, and NPS ensures a holistic financial plan.

Conclusion

Choosing the right Tax Saving Investments India 2026 helps reduce taxes while building long-term wealth. A combination of PPF, EPF, NPS, ELSS, FDs, SSY, NSC, and SCSS provides safety, returns, and diversification.

Pro Tip: Using the best Tax Saving Calculator 2026 to plan investments smartly and review your portfolio annually.

For more guidance, see Best Investment Options India 2026 on Kujoka News.