Last Updated: February 2026

Disclaimer: This article is for educational purposes only. Mutual funds carry market risks, and returns vary based on economic conditions, fund strategy, and individual financial situations. Always consult a certified financial advisor before making investment decisions.

Choosing the best mutual funds in India 2026 can help you plan long-term goals, manage risk better, and invest with clarity. Whether you prefer equity, debt, hybrid, or ELSS funds, understanding how each option works makes decision-making easier and more confident. For more ideas, check our best investment options in India 2026 guide.

Contents

- Why Mutual Funds in India 2026 Matter

- Top Mutual Funds in India 2026

- Infographics

- Quick Comparison Table

- How to Choose the Best Mutual Funds in India 2026

- Practical Tips

- FAQs

- Conclusion

Why Mutual Funds in India 2026 Matter

Mutual funds remain a preferred choice for investors in 2026 because they offer diversification, transparency, and access to professional fund management. Here’s why they matter:

- Wealth Growth: Funds allow long-term wealth building by investing across sectors and market cycles.

- Easy to Start: SIPs make investing accessible even with smaller monthly amounts.

- Goal-Based Planning: Different fund types support goals like education, home buying, retirement, and tax savings.

Example: A monthly SIP of ₹5,000 in a diversified equity fund may grow steadily over time, depending on market behaviour and fund performance.

Top Best Mutual Funds in India 2026

Equity Mutual Funds

Type: Market-linked, growth-focused

Returns: Historically around 10–15% CAGR

Suitable for: Long-term goals such as wealth creation

Pros: Higher growth potential

Cons: Market movement affects returns

Tip: Equity funds are core in the best mutual funds in India 2026 list for long-term investors seeking steady growth.

Equity Linked Savings Scheme (ELSS)

Type: Equity + tax-saving benefits

Lock-in: 3 years

Suitable for: Long-term tax planning

Pros: Eligible for tax deductions under Section 80C

Cons: Subject to market risk

Tip: ELSS funds can be part of both tax planning and wealth-building strategies.

Debt Mutual Funds

Type: Fixed-income instruments

Returns: Historically around 6–8%

Suitable for: Low-risk investors

Pros: Stability and predictable income

Cons: Lower growth compared to equity funds

Tip: Ideal for short-term goals and low-volatility portfolios.

Hybrid Mutual Funds

Type: Mix of equity + debt

Returns: Historically around 8–12%

Suitable for: Medium-risk investors seeking balance

Pros: Balanced exposure reduces volatility

Cons: Returns depend on equity market conditions

Tip: Works well for investors who prefer moderation between growth and safety.

Performance Snapshot of Popular Funds

Investors often check mutual funds based on historical returns, risk profile, and fund manager track record. Here are some common examples (2026 estimates):

| Fund Example | Category | Investor Goal | Risk Level |

|---|---|---|---|

| Flexi-Cap Equity Funds | Equity | Long-term growth | High |

| Large & Mid Cap Funds | Equity | Balanced growth | Moderate-High |

| Corporate Bond Funds | Debt | Income stability | Low-Moderate |

| Balanced Advantage Funds | Hybrid | Moderate-risk investing | Moderate |

This snapshot gives readers a quick reference of typical fund options for different goals and risk appetites. Always review latest performance before investing.

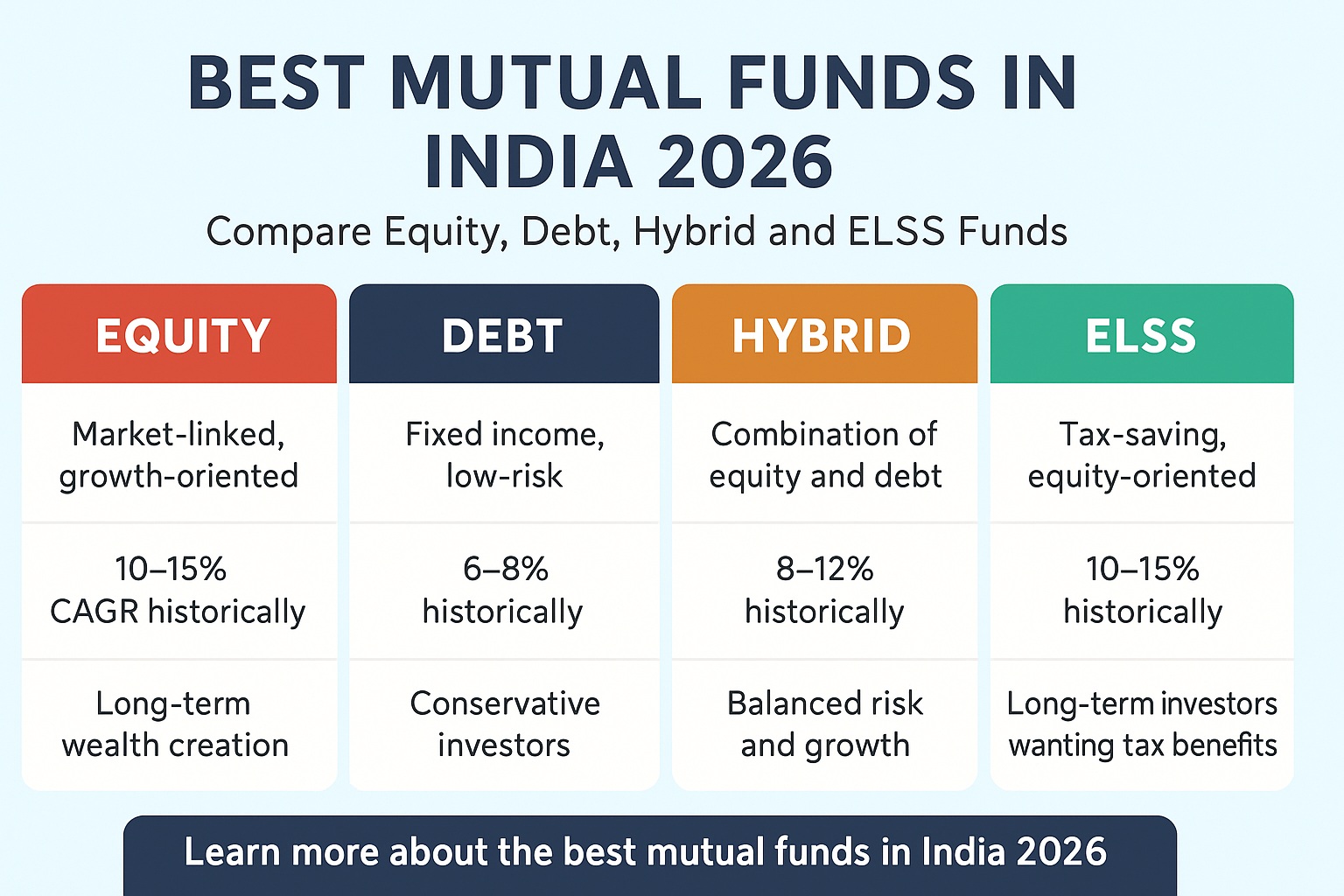

Infographics – Best Mutual Funds in India 2026

Below are two infographics highlighting key differences between equity, debt, hybrid, and ELSS funds. These visuals make it easier to understand how each category fits your investment plan.

Quick Comparison of Mutual Funds

| Fund Type | Risk | Returns | Investment Horizon | Notes |

|---|---|---|---|---|

| Equity | High | 10–15% | 5–10 yrs | Growth-focused, long-term option |

| Debt | Low | 6–8% | 1–3 yrs | Stable and suitable for short-term needs |

| Hybrid | Medium | 8–12% | 3–7 yrs | Balanced risk and reward |

| ELSS | High | 10–15% | 3 yrs lock-in | Tax-saving under 80C |

How to Choose the Best Mutual Funds in India 2026

- Risk Appetite: Choose equity for long-term growth and debt for stability.

- Investment Duration: Match your fund type with your financial timeline.

- Diversification: A mix of equity, debt, hybrid, and ELSS works well for most investors.

- Fund History: Check long-term consistency and fund manager experience.

- Internal Resource: Read Best Investment Options India 2026 for deeper guidance.

- External Authority: Refer to SEBI Guidelines for mutual fund regulations.

Practical Tips

- Start SIPs early to make the most of long-term investing.

- Diversify across two or more fund categories.

- Review portfolio performance every quarter.

- Use mutual fund calculators to understand potential growth.

- Combine mutual funds with PPF or NPS for a balanced portfolio.

Frequently Asked Questions (FAQs)

- Which are the best mutual funds in India 2026 for beginners?

- Beginners typically choose equity SIPs, hybrid funds, and ELSS because they offer diversification and simplicity.

- Are mutual funds risky?

- Risk depends on the fund category. Equity funds carry higher market risk, while debt funds provide more stability.

- Can I invest in multiple mutual funds?

- Yes. Diversifying across categories can help manage risk better.

- How much should I invest monthly?

- Even a SIP of ₹2,000–₹5,000 can be a good starting point, depending on your goals.

Conclusion

Choosing the best mutual funds in India 2026 becomes easier when you understand how each fund type works. A balanced mix of equity, debt, hybrid, and ELSS funds can support long-term and short-term financial goals.

Pro Tip: Stay consistent, diversify, and review your portfolio regularly to build confidence in your investment journey.

For more guidance, visit Best Investment Options India 2026 on Kujoka News.