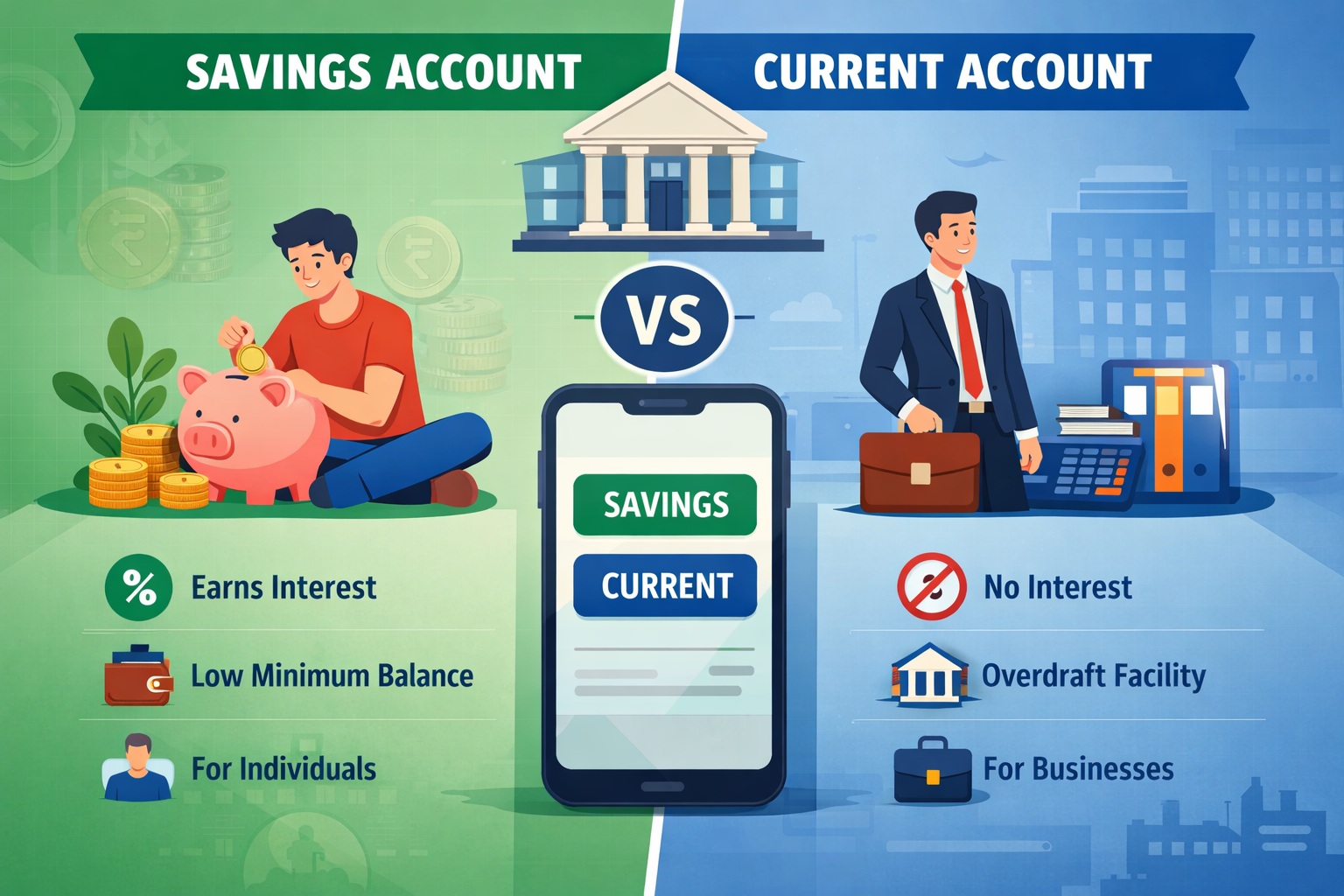

Managing finances effectively starts with understanding the different types of bank accounts available. In India, the two primary accounts are the Savings Account and Current Account. While both allow storing and accessing funds, they serve distinct purposes and are designed for different users. This comprehensive guide explores everything you need to know about Savings Account and Current Account, including features, benefits, fees, digital banking, and practical guidance to help you choose the right account for your needs.

Whether you are opening your first bank account or managing multiple accounts, understanding the nuances of Savings Account and Current Account is essential for making informed financial decisions. Pairing your account strategy with mutual funds and tax‑saving investments can further enhance your financial growth.

What is a Savings Account?

A Savings Account is designed for individuals who want to save money while earning interest. It helps cultivate saving habits by providing a modest interest rate on deposited funds. Choosing the right Savings Account and Current Account combination can maximize your financial benefits.

Key features of a Savings Account:

- Interest Earnings: Typically range between 3–7% per year, depending on the bank and account balance. Here are some examples of current savings account interest rates from reputed banks in India or visit the official site of your own bank.

- SBI Savings Account: Check rates

- HDFC Bank Savings Account: Check rates

- ICICI Bank Savings Account: Check rates

- Axis Bank Savings Account: Check rates

- Kotak Mahindra Bank Savings Account: Check rates

- IDFC FIRST Bank Savings Account: Check rates

- Minimum Balance Requirement: Can range from zero (for zero balance accounts) to ₹10,000.

- Transaction Limits: Usually includes a limited number of free transactions per month; additional transactions may attract fees.

- Ideal Users: Salaried individuals, students, retirees, and anyone looking to save money over time.

Savings accounts also provide easy access through ATMs, net banking, mobile banking, and cheques. For investors looking to grow their funds beyond a traditional savings rate, explore best mutual funds in India. Most modern savings accounts integrate with UPI and mobile payment platforms, making the Savings Account and Current Account combination convenient for daily use.

What is a Current Account?

A Current Account is primarily intended for businesses, traders, and entrepreneurs who need to handle frequent and large-volume transactions. Unlike a savings account, a Current Account generally does not earn interest, as its main purpose is transactional rather than for savings.

Key features of a Current Account:

- Unlimited Transactions: Designed to manage high-volume daily transactions.

- Overdraft Facility: Many current accounts offer overdrafts to help businesses manage short-term cash flow.

- Minimum Balance Requirement: Typically higher than savings accounts, often starting from ₹10,000 or more.

- Ideal Users: Businesses, companies, freelancers with regular client payments, and individuals managing bulk transactions.

With the right Savings Account and Current Account setup, businesses can separate personal finances from operational funds and improve cash flow management. Small business owners may also find our step-by-step guide to start a small business in India helpful for planning their finances efficiently.

Key Differences Between Savings Account and Current Account

| Feature | Savings Account | Current Account |

|---|---|---|

| Purpose | Saving money and earning interest | Managing frequent transactions for business |

| Interest | Earns interest (3–7%) | Usually no interest |

| Transactions | Limited free transactions per month | Unlimited transactions |

| Minimum Balance | Low or zero balance | Higher minimum balance |

| Overdraft | Rarely available | Common for businesses |

| Ideal Users | Individuals, students, retirees | Businesses, traders, freelancers |

| Digital Banking | UPI, net banking, mobile apps | UPI, bulk transfer, payroll integration |

The Savings Account and Current Account differ primarily in purpose, transaction volume, and interest facilities. Understanding these differences ensures you select the right account combination for your financial goals.

Features and Benefits of Savings Account and Current Account

Benefits of a Savings Account:

- Encourages disciplined saving

- Provides interest on deposits

- Safe and insured storage of funds

- Easy access via digital channels

- Zero-balance options for students and low-income users

Benefits of a Current Account:

- Handles large, frequent transactions efficiently

- Overdraft facility aids short-term liquidity

- Multi-user access for business purposes

- Supports bulk transactions, payroll, and automation

- Professional financial tools like invoicing integration

Selecting the right Savings Account and Current Account combination can provide both security for personal funds and flexibility for business operations. Pairing these accounts with tax‑saving investments in India and best health insurance plans ensures a holistic financial strategy.

Fees, Charges, and Minimum Balance Requirements

Understanding fees helps avoid unnecessary charges:

Savings Account Charges:

- Penalty for not maintaining minimum balance

- Charges for additional ATM withdrawals beyond free limits

- Fees for bounced cheques or stop-payment requests

Current Account Charges:

- Higher minimum balance penalty

- Overdraft interest charges

- Fees for excess cash deposits

- Charges for extra cheque books or demand drafts

Practical Tip: Always review the bank’s detailed fee schedule before opening a Savings Account and Current Account.

Transaction Limits and Overdraft Facility

- Savings Account: Usually allows 3–5 free branch transactions per month; digital payments are often unlimited within UPI and app limits.

- Current Account: Provides unlimited transactions; overdraft limits depend on account type and banking history.

- Overdraft: Rarely available for savings accounts, but a common feature in current accounts for businesses.

By understanding transaction limits and overdraft rules, you can better manage your Savings Account and Current Account efficiently.

Digital Banking and Payment Integration

Digital banking is critical today:

- Savings Account: Supports UPI, net banking, mobile apps, and debit cards for personal use.

- Current Account: Advanced features include bulk transfers, payroll management, multi-user access, and automated payments.

- Both account types increasingly support real-time payments (RTGS/NEFT/IMPS).

A well-planned Savings Account and Current Account strategy ensures smooth personal and business transactions in the digital era.

How to Choose the Right Savings Account and Current Account

- For Individuals: Savings accounts suit personal finance, small transactions, and earning interest.

- For Businesses: Current accounts provide flexibility, overdraft, and tools for frequent transactions.

- For Freelancers: Depending on income flow, maintain both to separate personal and business funds.

- Decision Checklist: Consider transaction frequency, interest needs, digital usage, and minimum balance before opening an account.

- Combine With Investments: Pairing a Savings account and Current Account with mutual funds or tax-saving investments can enhance your financial growth.

Regulatory Guidelines and Deposit Insurance

- Both accounts are regulated by the Reserve Bank of India – Banking Guidelines.

- Deposits in savings accounts are insured up to ₹5 lakh per depositor per bank under Deposit Insurance in India.

- Current accounts are also insured, but overdraft amounts are considered borrowings and not covered.

- Banks may monitor accounts to ensure correct usage.

Understanding regulations helps users choose the right Savings Account and Current Account and avoid compliance issues. Small business owners can also refer to MSME guidelines for managing their accounts efficiently.

Practical Examples

- Student: Zero-balance savings account with UPI access.

- Salaried Employee: Standard savings account with interest earnings.

- Freelancer: Savings account for personal use + current account for client payments.

- Small Business Owner: Current account with overdraft for payroll and supplier payments.

- Retiree: Savings account for pension deposits and safe withdrawals.

These examples demonstrate practical uses of Savings Account and Current Account in real life.

FAQs About Savings Account and Current Account

1. Can I have both a savings and a current account?

Yes, individuals and businesses can maintain both accounts to separate personal savings from business transactions.

2. Can I use a savings account for business transactions?

Technically yes, but banks may restrict usage if transactions exceed normal personal limits. A current account is recommended for business.

3. Do both accounts support UPI payments?

Yes, most modern accounts support UPI, but limits may differ.

4. What is an overdraft facility?

An overdraft allows current account holders to withdraw more than their account balance up to a pre-approved limit.

5. Are savings accounts insured?

Yes, up to ₹5 lakh per depositor per bank under DICGC insurance.

6. How do fees differ between accounts?

Savings accounts have lower minimum balances and fewer free transactions. Current accounts have higher balances and overdraft fees.

7. Can interest rates change in savings accounts?

Yes, banks may revise interest rates based on RBI policies.

8. How do I choose the best Savings Account and Current Account combination?

Consider your transaction volume, interest needs, digital usage, and whether you require overdraft facilities. Pair it with mutual funds, tax-saving investments, or health insurance plans for a comprehensive financial approach.