How to Save Money is not about extreme sacrifice or cutting all enjoyment from life. It is about understanding where your money goes, making informed decisions, and building habits that help you stay financially secure over time. Many people struggle with finances not because they earn too little, but because they never learned How to Save Money in a structured and realistic way.

With rising costs of food, housing, fuel, healthcare, and education, learning how to develop saving discipline has become a basic life skill. Small financial mistakes repeated over time quietly weaken stability, while simple savings habits, when practiced consistently, create long-term security. This complete guide explains saving money effectively step by step, using practical examples, realistic strategies, and habits that work for different income levels.

Before You Save — Understand Your Money Mindset

Before applying techniques for How to Save Money, it is important to understand how your mindset affects financial behavior. Money decisions are often emotional, not logical. Without awareness, even a good income fails to translate into savings.

Common Psychological Barriers

Impulse spending: Emotional purchases reduce your ability to save without you realizing it.

Social pressure: Trying to match others’ lifestyles makes How to Save Money difficult.

Lifestyle inflation: Higher income often leads to higher spending instead of higher savings.

Short-term thinking: Ignoring future needs weakens long-term financial planning.

Shifting to a Saving Mindset

To master Saving Money, you must:

- Treat saving as freedom, not restriction

- Identify emotional spending triggers

- Set meaningful goals instead of vague intentions

- Appreciate small progress and consistency

A healthy mindset forms the foundation of saving money successfully.

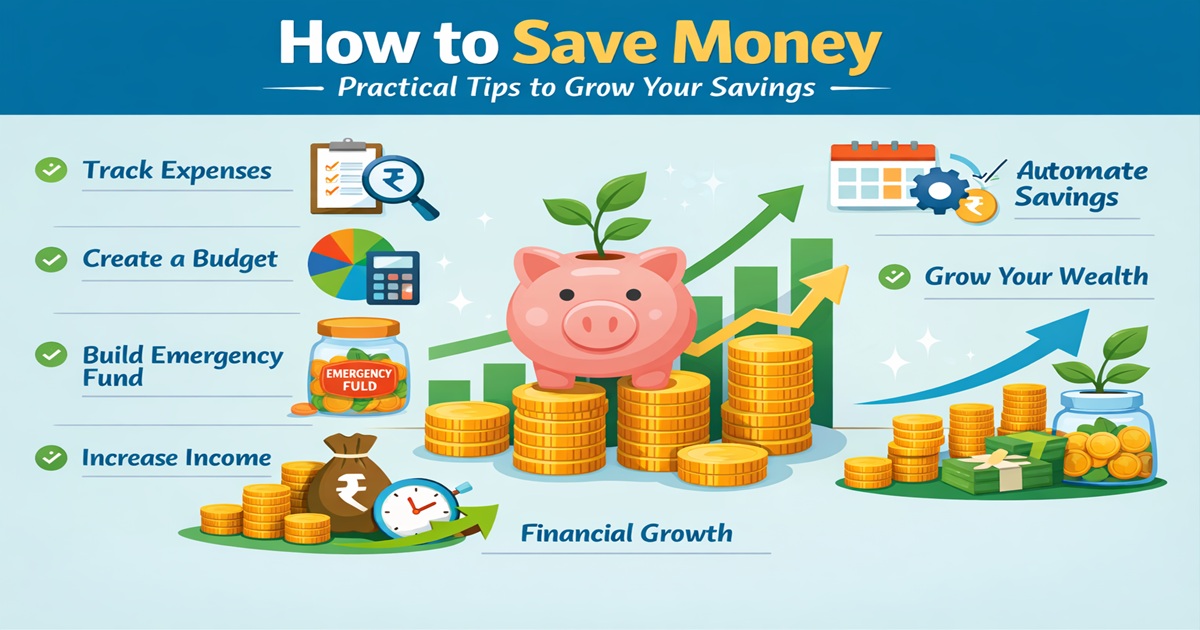

1 — Track Every Expense to Learn How to Save Money

Tracking expenses is the first practical step in learning to Save Money. Without knowing where your money goes, saving becomes guesswork.

How to Track Expenses

- Record every expense for at least 30 days

- Categorize spending into needs, wants, and savings

- Review weekly and monthly totals

Example:

₹150 daily coffee → ₹4,500/month → ₹54,000/year

This single habit can block progress in Saving Money without you noticing.

Tracking builds awareness and creates control.

2 — Build a Realistic Budget to Save Money Consistently

A budget is not a restriction; it is a plan. Learning to Save Money becomes easier when every rupee has a role.

Simple Budget Structure

- Essentials: Rent, food, utilities, transport

- Savings: Fixed, non-negotiable

- Discretionary: Entertainment, dining, hobbies

Budgeting Methods That Work

- 50/30/20 method

- Zero-based budgeting

- Envelope system

A realistic budget supports saving habits without damaging quality of life. For more on accounts and budgeting, check Savings Account and Current Account.

3 — Set Clear Financial Goals to Save Money

Goals turn intention into action. Without goals, How to Save Money feels abstract and unmotivating.

Types of Financial Goals

- Emergency fund

- Short-term purchases

- Long-term security

SMART Goal Example

“I will save ₹2,000 monthly for 12 months to build a ₹24,000 emergency fund.”

Clear goals strengthen discipline in Saving Money.

4 — Pay Yourself First

One of the most effective principles in saving money is saving before spending.

Instead of saving leftovers, move savings immediately after income arrives.

Example:

₹3,000 per month → ₹36,000 per year

Gradually increase this amount as income grows.

This habit ensures How to Save Money works even during busy or unpredictable months.

5 — Automate Your Savings

Automation removes emotion and excuses. It is a powerful tool for improving saving behavior.

Ways to Automate

- Automatic bank transfers

- Separate savings accounts

- Round-up saving features

Automation helps create a saving routine that stays consistent without daily effort.

6 — Build an Emergency Fund When Learning How to Save Money

An emergency fund protects your savings from sudden shocks like medical expenses or job loss.

How Much to Save

- Start small: ₹5,000–₹10,000

- Target: 3–6 months of essential expenses

Without an emergency fund, progress in Saving Money can collapse overnight.

7 — Reduce Expenses Without Sacrificing Lifestyle

Learning how to reduce unnecessary spending does not mean removing joy from life. Smart adjustments create savings naturally.

Practical Cost-Cutting Ideas

- Cancel unused subscriptions

- Cook more at home

- Plan purchases

- Compare prices

- Avoid “spending to save” traps

Small changes can free thousands annually and support How to Save Money sustainably.

8 — Use Technology to Save Money

Technology simplifies saving by improving tracking and accountability.

Helpful Tools

- Expense-tracking apps

- Budget dashboards

- Savings visualizers

Seeing progress reinforces discipline and consistency in saving money.

9 — Increase Income to Strengthen How to Save Money

Expense reduction has limits. Income growth accelerates smart saving strategies.

Income-Boosting Options

- Freelancing

- Online tutoring

- Selling unused items

- Side gigs

Even ₹2,000 extra per month directly improves saving outcomes.

10 — Manage Debt Wisely

High-interest debt weakens saving progress.

Smart Debt Practices

- Pay high-interest loans first

- Avoid unnecessary borrowing

- Consolidate when possible

Reducing interest improves cash flow and strengthens your ability to save money.

11 — Government Schemes That Support Saving Money

Government-backed schemes provide safety and structure for long-term savings.

Popular Options

- Public Provident Fund (PPF) – Official PPF Scheme Details

- National Savings Certificate (NSC) – Official NSC Scheme Details

- Sukanya Samriddhi Yojana

- Small Savings Schemes

These instruments align well with How to Save Money for stability-focused individuals.

12 — Use Compound Interest for Long-Term Growth

Compound interest rewards time and consistency.

Saving ₹1,000 monthly at moderate returns grows significantly over years.

Starting early multiplies the effect of Saving Money.

13 — Gamify Your Saving Habits

Gamification keeps How to Save Money engaging.

Popular Challenges

- 52-week savings challenge

- Monthly increase challenge

- Round-up savings challenge

Challenges turn discipline into motivation.

14 — Plan Seasonal and Festival Expenses

Unplanned seasonal spending harms saving efforts.

Planning early avoids debt and protects savings.

15 — Real-Life Case Studies

Student Example

Tracking expenses and part-time income increased savings from ₹500 to ₹2,000 monthly.

Young Professional Example

Structured planning helped significantly improve annual savings in this example.

These examples show How Saving Money works in real life. For broader finance management, see How to Manage Personal Finances Effectively.

16 — Avoid Common Saving Mistakes

Ignoring small expenses

Delaying saving

Underestimating compounding

Not adjusting goals

Avoiding these mistakes strengthens realistic saving habits.

17 — Adjust Savings for Inflation

Inflation reduces purchasing power. Regularly updating targets keeps How to Save Money effective.

18 — How Saving Money Improves Mental Health and Stability

Financial stress is one of the leading causes of anxiety in daily life. When expenses are unplanned and income feels insufficient, stress quietly builds over time. Developing strong saving habits reduces this pressure by creating predictability and control.

Even small savings provide psychological security. Knowing that emergency expenses can be handled without borrowing improves confidence and decision-making. This emotional benefit is often overlooked, but it is one of the strongest long-term advantages of building savings.

People with consistent savings habits report better sleep, improved focus at work, and fewer impulsive financial decisions. Financial stability supports mental clarity, which in turn reinforces disciplined money habits.

19 — Saving Money at Different Life Stages

Saving strategies should evolve with age and responsibility. What works for a student may not work for a family or a retiree.

Students and Early Earners

Focus on habit-building, tracking expenses, and avoiding debt. Even small monthly savings create discipline.

Working Professionals

Prioritize emergency funds, structured investments, and planned savings goals. Income growth should increase savings, not lifestyle inflation.

Families

Account for education, healthcare, and long-term security. Budgeting and planning are critical to avoid financial strain.

Pre-Retirement Phase

Stability, low-risk instruments, and predictable income streams become more important than aggressive growth.

Understanding life-stage needs strengthens financial planning and avoids unrealistic expectations.

20 — How Inflation Silently Erodes Savings

Inflation reduces the real value of money over time. Savings that do not grow fail to maintain purchasing power.

Strategies to manage inflation impact:

- Increase savings amounts gradually

- Use interest-bearing instruments

- Avoid holding large idle cash balances

21 — Building Discipline Without Burnout

Many people start saving aggressively and then quit due to burnout. Sustainable habits are more effective than extreme restrictions.

Healthy discipline includes:

- Allowing planned enjoyment expenses

- Reviewing progress monthly, not daily

- Adjusting goals when income changes

22 — Measuring Progress the Right Way

Progress should be measured objectively, not emotionally.

Effective tracking methods include:

- Monthly net savings growth

- Reduction in unnecessary expenses

- Increase in emergency fund balance

23 — Long-Term Thinking vs Short-Term Sacrifice

True financial improvement comes from long-term thinking. Small, repeated actions outperform large one-time efforts.

Frequently Asked Questions

What is the best way to learn how to save money?

Start by tracking expenses, setting goals, and automating savings.

How much should I save monthly?

Begin with 10–20% and increase gradually.

Can small savings grow over time?

Yes. Consistency makes How to Save Money powerful.

How do I save with irregular income?

Save a fixed base amount and redirect surplus immediately.

How often should I review my budget?

Monthly reviews keep How to Save Money on track.