Meghalaya Insurance Schemes 2026: Ultimate Guide for Residents

Residents of Meghalaya can access a wide range of insurance and government-backed programs designed to provide financial security, social welfare, and protection against unexpected events. This comprehensive guide covers Meghalaya Insurance Schemes 2026, including health, life, social welfare, and agriculture-related programs. It also provides practical examples, step-by-step application tips, and insights to help families, farmers, and individuals make the most of these opportunities. Note: Benefits depend on eligibility as per government guidelines.

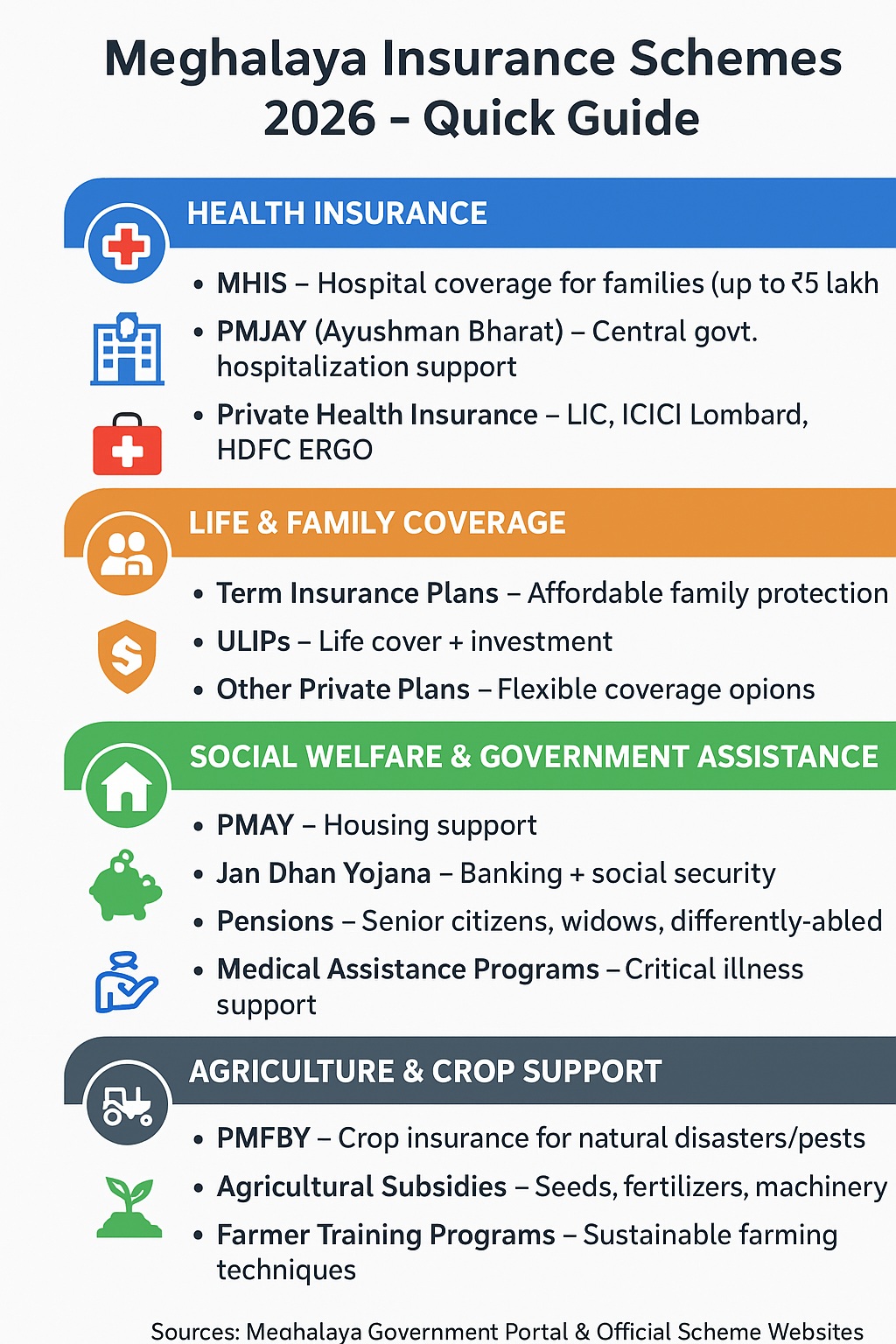

Health Insurance Options in Meghalaya 2026

Health insurance is a crucial component of financial security, helping families manage medical expenses and access quality healthcare. Key schemes under Meghalaya Insurance Schemes 2026 include:

- Meghalaya Health Insurance Scheme (MHIS): Provides hospitalization coverage for eligible families. Example: A family of four in Shillong may receive up to ₹5 lakh coverage for surgeries, critical illness treatment, and hospitalization. (Source: Meghalaya Government Portal)

- Ayushman Bharat – PMJAY: Central government program offering financial support for hospitalization, surgeries, and critical illnesses to eligible households. Benefits can go up to ₹5 lakh per family annually. (Source: PMJAY Official Website)

- Private Health Insurance: Insurers like LIC, ICICI Lombard, and HDFC ERGO provide additional coverage, including maternity benefits, outpatient care, and accidental support.

Eligibility & Application Tips

- Verify residency and income criteria for both state and central schemes.

- Compare coverage limits, network hospitals, and premiums before choosing a plan.

- Prepare documents: ID, address proof, income certificate, and family details.

- Apply online through government portals or offline at local offices.

- Understand claim procedures to ensure smooth reimbursements.

- Keep a checklist of hospitals and approved treatments under each scheme.

- Residents can maximize benefits by enrolling in multiple schemes under Meghalaya Insurance Schemes 2026.

Life Insurance in Meghalaya

Life insurance ensures financial protection for families in case of unforeseen events. Popular options under Meghalaya Insurance Schemes 2026 include:

- Term Insurance Plans: Affordable and straightforward coverage, ideal for young families.

- Unit Linked Insurance Plans (ULIPs): Combines life coverage with investment opportunities for wealth growth.

- Other Private Plans: Flexible coverage tailored to individual needs, including accidental and critical illness riders.

Tips for Choosing Life Insurance

- Assess family responsibilities and long-term financial goals.

- Compare premiums, benefits, and claim settlement history of insurers.

- Choose plans that complement government-backed insurance under Meghalaya Insurance Schemes 2026.

- Consider riders like accidental death or critical illness coverage for added protection.

- Example: A 30-year-old earning ₹7 lakh annually may choose a ₹50 lakh term plan with accidental rider for complete family protection.

Social Welfare & Government Assistance in Meghalaya

Several social welfare programs help residents access financial support and healthcare. Key initiatives under Meghalaya Insurance Schemes 2026 include:

- Pradhan Mantri Awas Yojana (PMAY): Housing support for eligible families in rural and urban areas. (Source: PMAY Official Website)

- Financial Inclusion Programs: Jan Dhan Yojana offers banking access, savings accounts, and social security benefits.

- Pension & Support Schemes: Assistance for senior citizens, widows, and differently-abled residents.

- Medical Assistance Programs: Additional support for preventive care, specialized treatments, and critical illnesses.

Tips for Residents

- Check eligibility regularly for newly launched schemes.

- Keep all documents updated for smooth claims.

- Combine state and central programs where possible for maximum benefits.

- Example: A senior citizen can receive pension benefits and health coverage simultaneously under Meghalaya Insurance Schemes 2026.

Agriculture & Crop Support in Meghalaya 2026

Farmers benefit from specialized programs designed to protect crops and ensure income stability. Key programs include:

- Pradhan Mantri Fasal Bima Yojana (PMFBY): Insurance against crop losses due to natural disasters, pests, or disease. Claims are typically processed within 90 days. (Source: PMFBY Official Website)

- Agricultural Subsidies: Support for seeds, fertilizers, irrigation systems, and farm machinery.

- Farmer Training Programs: Guidance on modern and sustainable farming techniques.

- State-specific Schemes: Meghalaya government provides additional support for terrace farming, horticulture, and small-scale farmers.

Application Tips for Farmers

- Maintain farm records and crop details for insurance claims.

- Visit local agriculture offices or online portals for guidance on subsidies and insurance enrollment.

- Adhere to deadlines and claim procedures to avoid delays in compensation.

- Example: A horticulture farmer in East Khasi Hills applies for PMFBY and receives compensation within 60 days after a hailstorm.

State vs Central Schemes

Understanding the distinction between state and central programs is key to maximizing benefits under Meghalaya Insurance Schemes 2026:

- State Schemes: MHIS, state pensions, local agricultural subsidies.

- Central Schemes: PMJAY, PMFBY, PMAY.

- Combining state and central programs ensures comprehensive coverage.

FAQs about Meghalaya Insurance Schemes 2026

- Who can apply for MHIS? Families meeting the residency and income criteria in Meghalaya.

- How do I claim crop insurance? File claims via local agriculture offices or online portals within the stipulated period.

- Are private insurance plans mandatory? No, but they complement government schemes for broader coverage.

- Can I apply online for PMAY? Yes, applications are accepted through the official portal or local offices.

- Processing times? Health insurance: 15–30 days, crop insurance: 90 days, pensions: monthly.

- Can multiple schemes be combined? Yes, residents can combine state and central schemes for maximum coverage.

- What documents are required? ID, address proof, income certificate, and family details for all applications.

- Where can I get guidance? Local government offices, online portals, or helplines.

How to Apply for Meghalaya Insurance Schemes 2026

- Visit official government portals or local offices. Meghalaya Government Schemes

- Prepare ID, address proof, income certificate, and family details.

- Submit applications online or offline as per instructions.

- Keep copies of all applications for future reference.

- Regularly check application status to ensure timely approval and benefits.

Summary

Meghalaya Insurance Schemes 2026 provide residents with access to health, life, social welfare, and agricultural support. Understanding eligibility, benefits, and application procedures allows families and individuals to plan effectively. Combining state, central, and private insurance ensures comprehensive coverage and financial security. All benefits are subject to government guidelines.

Also read: